The UK Budget 2025 has landed, and its implications for the housing sector, particularly co-living and Houses in Multiple Occupation (HMO’s) are significant. With tax changes, regulatory pressures, and shifting market dynamics, landlords and operators need to understand what’s coming and how to adapt.

Key Budget Measures Affecting HMO’s

-

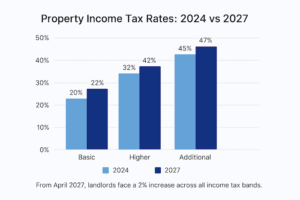

Property Income Tax Increase

From April 2027, landlords will pay 2% more across all income tax bands on property income:

- Basic rate: 22% (up from 20%)

- Higher rate: 42% (up from 40%)

- Additional rate: 47% (up from 45%)

Impact: Margins will tighten, especially for landlords with large portfolios or high leverage. Expect some landlords to increase rents to offset these costs.

-

Stamp Duty Stability

The Budget confirmed no changes to stamp duty and no new annual property tax for homes over £500,000. This stability may encourage continued investment in HMOs, as landlords avoid additional upfront costs.

-

Council Tax Surcharge

A ‘Mansion Tax’ will apply from 2028 on homes worth over £2m. While this affects a small segment of the market, it signals the government’s intent to target wealthier property owners.

-

Compliance and Energy Efficiency

The Budget reinforced commitments to energy efficiency upgrades under the Renters’ Rights Act. While grants and incentives are expected, older HMO properties may require significant investment to meet standards.

-

Market Sentiment

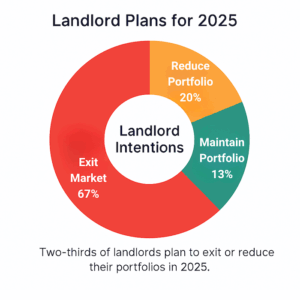

According to Spareroom, 67% of landlords planned to exit or reduce portfolios in 2025 even before the Budget. Higher taxes could accelerate this trend, reducing supply and pushing rents up further.

Data Snapshot: HMO Market Trends

Here’s how the market looks today:

| Metric | 2024 | 2025 (Projected) |

| Average HMO Rent (UK) | £550/month | £580–£600/month |

| Landlord Exit Rate | 55% | 67% |

| Energy Upgrade Costs | £4,000 avg | £5,500 avg |

What This Means for Co-Living Operators

- Short-Term: Stability in stamp duty offers reassurance for investors.

- Medium-Term: Rising tax rates and compliance costs could lead to rent hikes.

- Long-Term: Reduced landlord participation may create a supply crunch, making HMO’s even more attractive for tenants seeking affordability.

Action Points for Landlords

- Review tax planning strategies now.

- Explore energy efficiency grants early.

- Consider rent adjustments to maintain profitability.

Bottom Line: The 2025 Budget signals a tougher environment for landlords but could strengthen demand for co-living as tenants seek cost-effective housing.